Mastering Candle.Option Trading: A Comprehensive Guide

November 22, 2024Candle.option trading can seem daunting for newcomers, but with a solid understanding of the underlying principles and strategies, it can become a powerful tool for achieving financial goals. This guide delves into the intricacies of candle.option trading, providing valuable insights and practical tips to empower you on your trading journey.

Understanding the Basics of Candle.Option

Before diving into complex strategies, it’s crucial to grasp the fundamental concepts of candle.option trading. A candle.option is a financial contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). Understanding how these options work in conjunction with candlestick patterns is key to successful trading.

Candlestick Patterns and Their Significance

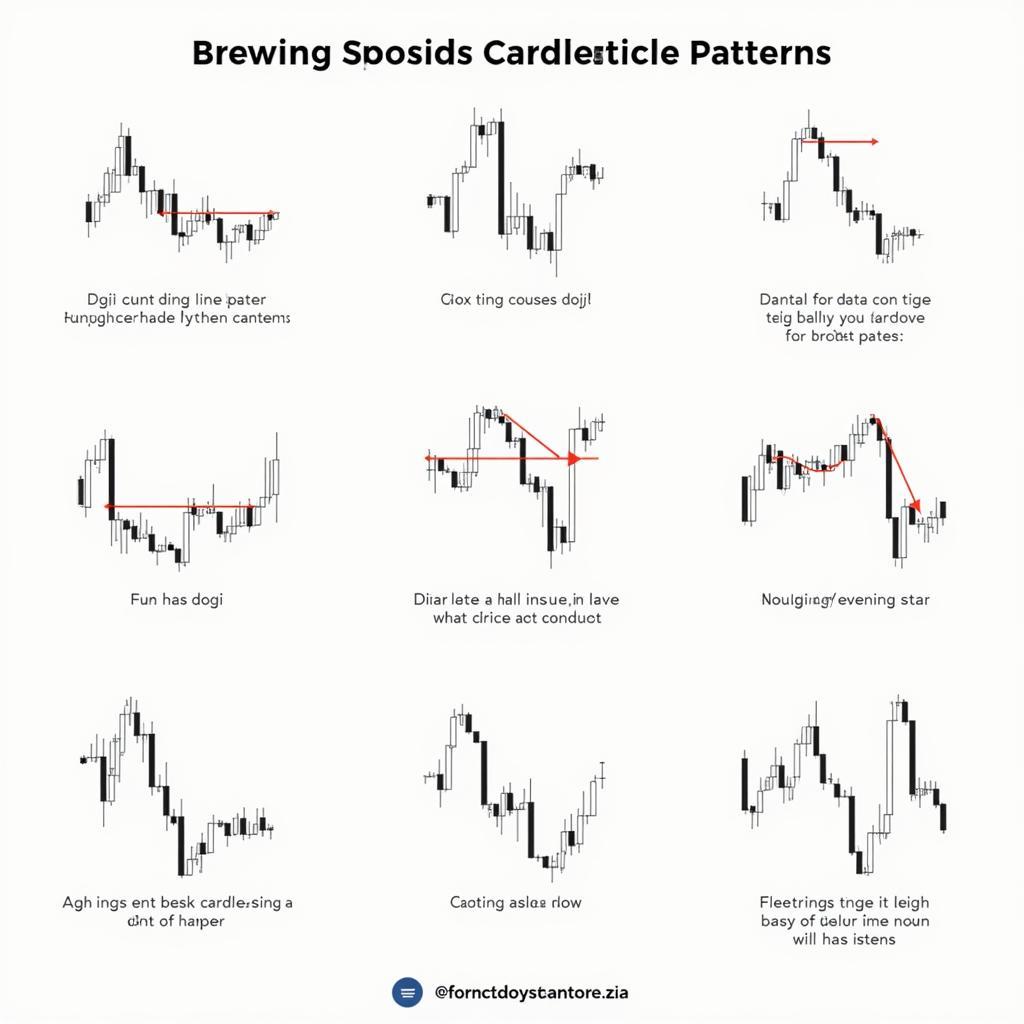

Candlestick patterns are visual representations of price movements over a given period. They provide valuable insights into market sentiment and potential future price action. Recognizing and interpreting these patterns is essential for effective candle.option trading. Common patterns include doji, hammer, engulfing patterns, and morning/evening stars. Each pattern tells a different story about the market’s momentum and potential reversals.

Candlestick Patterns Explained

Candlestick Patterns Explained

Developing a Winning Candle.Option Strategy

A well-defined strategy is the cornerstone of successful candle.option trading. There’s no one-size-fits-all approach, so it’s important to develop a strategy that aligns with your risk tolerance, financial goals, and trading style.

Combining Technical and Fundamental Analysis

While candlestick patterns provide valuable technical insights, incorporating fundamental analysis can further enhance your candle.option trading strategy. By analyzing the underlying asset’s financial health, industry trends, and macroeconomic factors, you can gain a more comprehensive understanding of its potential future performance.

Combining Technical and Fundamental Analysis

Combining Technical and Fundamental Analysis

Risk Management: Protecting Your Capital

Effective risk management is paramount in candle.option trading. It involves defining your maximum acceptable loss per trade, diversifying your portfolio, and using stop-loss orders to limit potential losses. Never invest more than you can afford to lose, and always have a clear exit strategy in place.

“A successful trader is not someone who always wins, but someone who knows how to manage their losses effectively.” – John Miller, Senior Options Trading Strategist

Advanced Candle.Option Techniques

Once you’ve mastered the basics, you can explore more advanced techniques to refine your candle.option trading strategies.

Options Spreads and Combinations

Options spreads involve simultaneously buying and selling multiple options contracts with different strike prices or expiration dates. These strategies can be used to limit risk, generate income, or profit from specific market conditions.

Volatility and its Impact on Candle.Option Pricing

Volatility, a measure of price fluctuations, plays a significant role in candle.option pricing. Understanding how volatility affects option premiums can help you make informed trading decisions. Higher volatility generally leads to higher option premiums, while lower volatility tends to decrease premiums.

Conclusion

Candle.option trading offers immense potential for profit, but it also carries inherent risks. By mastering the fundamentals, developing a sound strategy, and continuously learning, you can increase your chances of success in this exciting market. Remember to always prioritize risk management and stay disciplined in your approach to candle.option trading.

FAQ

- What are the different types of candle.option contracts?

- How do I calculate the value of a candle.option?

- What are the risks associated with candle.option trading?

- How can I use candlestick patterns to predict market movements?

- What are some common candle.option trading strategies?

- Where can I learn more about candle.option trading?

- What are the best resources for staying updated on market trends?

When you need assistance, please contact Phone Number: 0915117113, Email: [email protected] Or visit: Hamlet 3, Binh An, Phu Thuong, Vietnam, Binh Phuoc 830000, Vietnam. We have a 24/7 customer service team.