FBS Price: A Comprehensive Guide

November 12, 2024Fbs Price refers to the fees and commissions charged by FBS, a popular online forex and CFD broker. Understanding FBS price is crucial for traders looking to optimize their trading costs and maximize profitability. This guide will delve into the various aspects of FBS price, including spreads, commissions, swap fees, and other charges.

Decoding FBS Price Structure

FBS offers a variety of account types, each with its own pricing structure. Choosing the right account depends on your trading style, experience level, and capital. Let’s break down the key components of FBS price:

- Spreads: The spread is the difference between the bid and ask price of a currency pair. FBS offers both fixed and floating spreads. Fixed spreads remain constant regardless of market volatility, while floating spreads can fluctuate depending on market conditions. Traders looking for predictable costs often prefer fixed spreads.

- Commissions: Some FBS accounts charge a commission per trade, typically on ECN accounts which offer tighter spreads. This commission is usually a small percentage of the trade volume.

- Swap Fees: Swap fees, also known as rollover fees, are charged for holding positions overnight. These fees can be positive or negative depending on the interest rate differential between the currencies in the pair.

- Other Charges: FBS may also charge fees for inactivity, deposits, or withdrawals depending on the payment method used.

Choosing the Right FBS Account Based on Price

FBS offers several account types with varying price structures:

- Cent Account: This account is ideal for beginners, allowing them to trade with smaller lot sizes and lower risks. It generally has higher spreads than other account types.

- Micro Account: The Micro Account is a step up from the Cent Account, offering slightly lower spreads and larger lot sizes.

- Standard Account: This account is suitable for experienced traders, providing access to a wider range of instruments and tighter spreads.

- Zero Spread Account: As the name suggests, this account offers zero spreads on major currency pairs. However, it charges a commission per trade.

- ECN Account: The ECN Account provides direct market access with the lowest spreads available. However, it also charges a commission per trade.

FBS Account Types Comparison Table

FBS Account Types Comparison Table

Minimizing Your Trading Costs with FBS

Understanding FBS price allows you to make informed decisions and minimize your trading costs. Here are some tips:

- Choose the Right Account: Select an account type that aligns with your trading style and capital.

- Analyze Spreads: Compare the spreads offered by FBS with other brokers to ensure you’re getting a competitive price.

- Factor in Commissions: If you’re considering an ECN or Zero Spread account, calculate the total cost of your trades, including commissions.

- Understand Swap Fees: Be aware of the swap fees associated with holding positions overnight and factor them into your trading strategy.

- Utilize FBS Promotions: FBS often offers promotions and bonuses that can help reduce your trading costs.

FBS Price Compared to Other Brokers

While FBS offers competitive pricing, it’s always wise to compare their offerings with other reputable brokers. Factors to consider include:

- Spreads and Commissions: Compare the overall cost of trading, including spreads and commissions.

- Account Types: Consider the variety of account types available and their respective features.

- Trading Platform: Evaluate the functionality and user-friendliness of the trading platform.

- Customer Support: Assess the quality and availability of customer support.

- Regulation and Security: Ensure the broker is regulated by a reputable authority and offers adequate security measures.

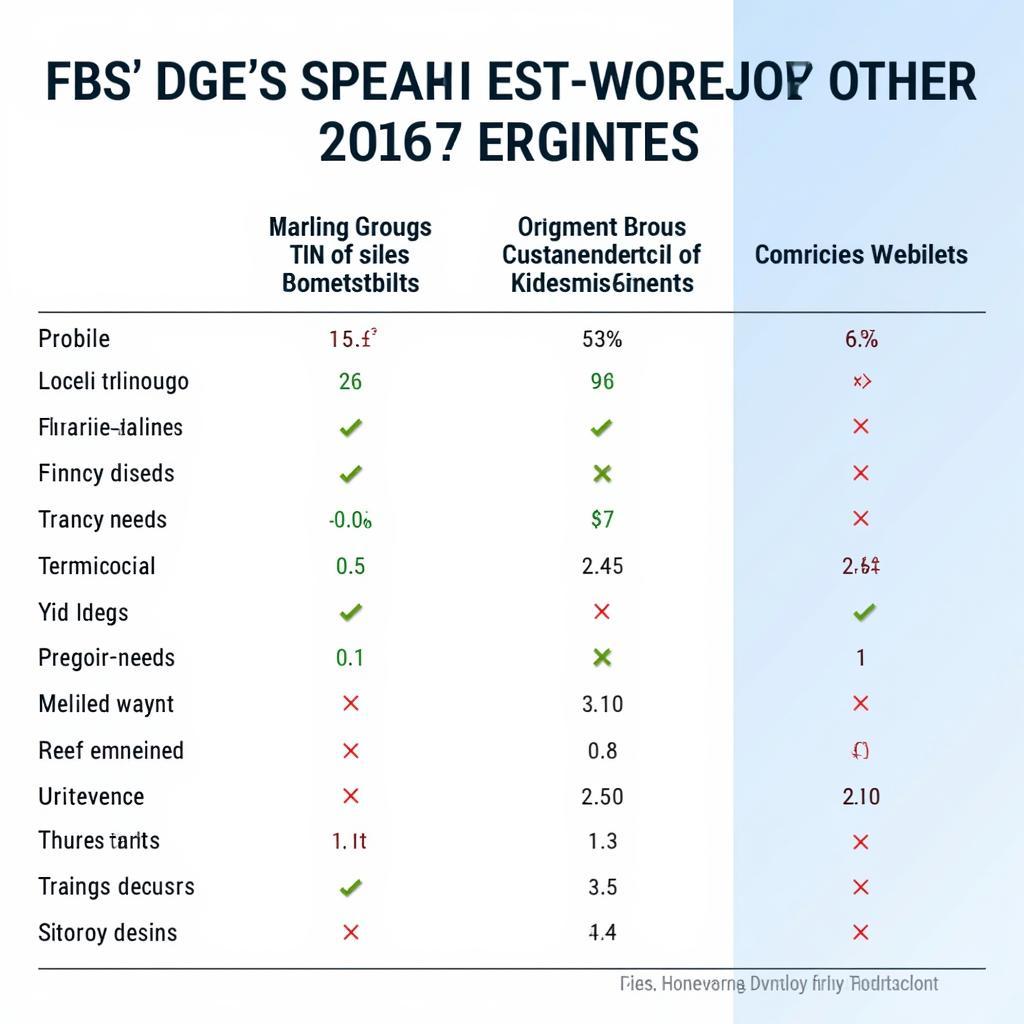

FBS vs. Other Brokers Comparison Chart

FBS vs. Other Brokers Comparison Chart

Conclusion: Mastering FBS Price for Profitable Trading

Understanding FBS price is essential for successful forex and CFD trading. By carefully analyzing the various components of FBS price, including spreads, commissions, and swap fees, you can choose the right account type, minimize your trading costs, and maximize your profits. Don’t forget to compare FBS with other brokers to ensure you’re getting the best possible deal.

FAQ

- What is the minimum deposit for an FBS account?

- Does FBS offer a demo account?

- What are the different trading platforms available with FBS?

- How can I contact FBS customer support?

- What are the available funding and withdrawal methods for FBS accounts?

- Does FBS offer any educational resources for traders?

- Is FBS a regulated broker?

For further assistance, please contact us: Phone: 0915117113, Email: [email protected] Or visit our address: Hamlet 3, Binh An, Phu Thuong, Vietnam, Binh Phuoc 830000, Vietnam. We have a 24/7 customer support team ready to assist you.