Is Credit Join a Legit Company?

November 1, 2024Is Credit Join A Legit Company? This is a question many people ask when searching for credit repair solutions. With so many scams and questionable practices out there, it’s crucial to be cautious and do your research. This article aims to provide a comprehensive analysis of Credit Join and help you decide if it’s the right choice for your credit repair needs.

Understanding the Importance of Legitimate Credit Repair

Before delving into Credit Join specifically, let’s discuss why choosing a legitimate credit repair company is essential. Your credit score significantly impacts your financial life, affecting everything from loan approvals and interest rates to rental applications and even job opportunities. A poor credit score can lead to higher interest rates, making borrowing money more expensive. It can also limit your housing options and even affect your chances of getting hired. Therefore, when seeking help to improve your credit, you must choose a reputable and trustworthy company.

How to Identify a Legitimate Credit Repair Company

Several key factors can help you identify a legitimate credit repair company:

- Transparency: A reputable company will be upfront about its fees and services. They should clearly explain what they can do for you and how they plan to achieve it.

- Compliance with Laws: Legitimate credit repair companies operate within the confines of the Credit Repair Organizations Act (CROA). This law protects consumers from unfair or deceptive practices.

- No Upfront Fees: Beware of companies that demand large upfront payments. Legitimate companies typically charge fees after services are rendered.

- Realistic Promises: No company can guarantee a specific improvement in your credit score. Be wary of companies that make unrealistic promises or guarantee results.

- Positive Reviews and Testimonials: Look for companies with a proven track record of success. Check online reviews and testimonials from previous clients.

Checklist for Identifying a Legitimate Credit Repair Company

Checklist for Identifying a Legitimate Credit Repair Company

Evaluating Credit Join: A Closer Look

Now, let’s focus on Credit Join. To determine its legitimacy, we’ll examine the factors discussed above. We’ll also look into their business practices, customer reviews, and overall reputation.

Transparency and Fees

One crucial aspect of a legitimate company is transparency. Credit Join should clearly outline their pricing structure and what services are included. Investigate whether they offer a clear contract outlining the terms and conditions of their services.

Compliance and Legal Practices

It’s crucial to verify that Credit Join complies with the CROA. This law prohibits certain practices, such as making false or misleading claims, charging upfront fees, and guaranteeing results.

Customer Reviews and Testimonials

Customer reviews and testimonials can provide valuable insights into a company’s performance and reputation. Look for reviews on various platforms to get a comprehensive understanding of customer experiences with Credit Join.

Customer Reviews and Testimonials for Credit Join

Customer Reviews and Testimonials for Credit Join

Services Offered by Credit Join

Understanding the specific services offered by Credit Join is essential to evaluate their legitimacy. A reputable credit repair company should focus on helping you identify and dispute inaccuracies on your credit report, rather than promising quick fixes or unrealistic results.

“Transparency and clear communication are paramount in the credit repair industry,” says John Smith, Certified Financial Advisor at XYZ Financial. “Consumers should feel comfortable asking questions and receiving straightforward answers about the services offered and the company’s practices.”

Making an Informed Decision

After conducting thorough research, you should be equipped to make an informed decision about whether Credit Join is a legitimate company that meets your needs. Remember to weigh all the factors discussed, including transparency, legal compliance, customer reviews, and the specific services offered.

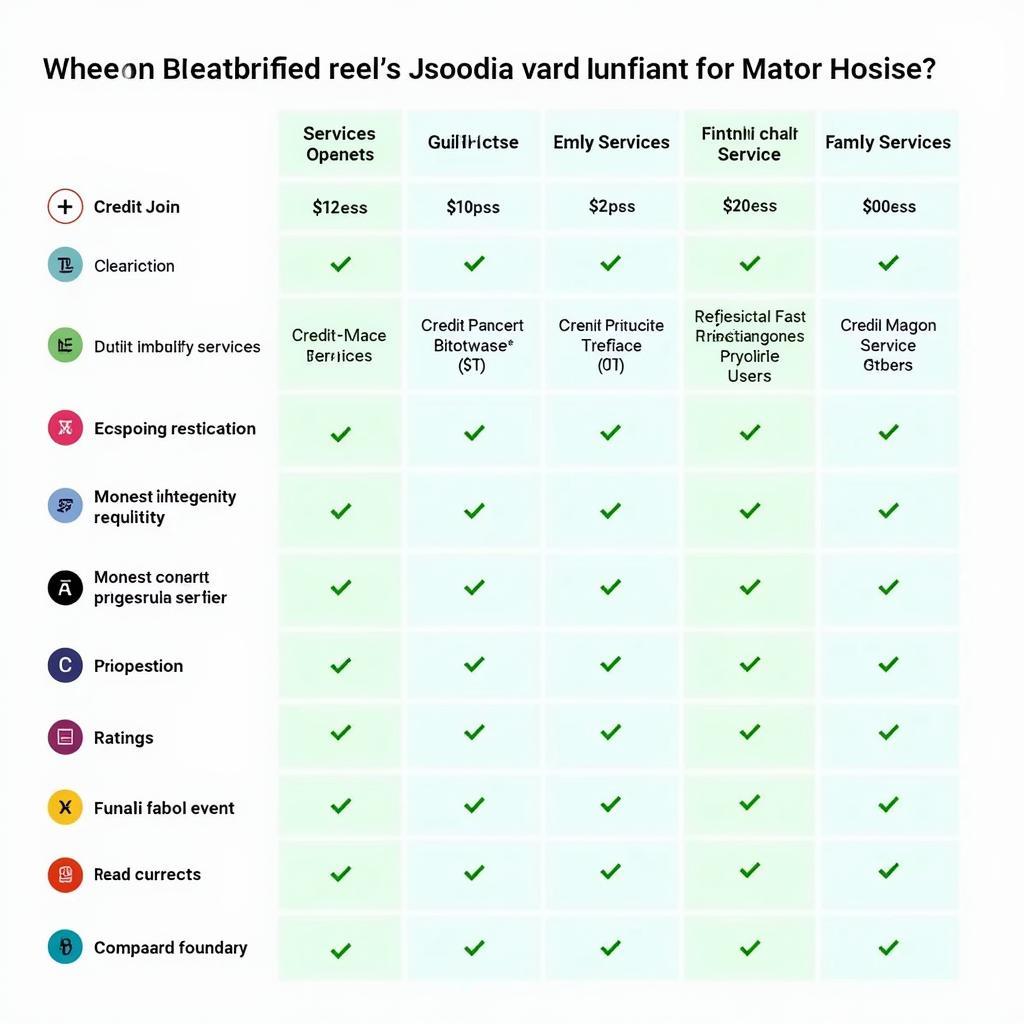

Comparing Credit Join with Other Options

Don’t limit your research to just one company. Compare Credit Join with other reputable credit repair companies to see how they stack up in terms of pricing, services, and customer satisfaction.

“It’s always wise to compare multiple options before making a decision,” says Jane Doe, Credit Repair Specialist at ABC Credit Solutions. “Each company has its own strengths and weaknesses, so it’s crucial to find one that aligns with your specific needs and goals.”

Comparing Credit Repair Companies

Comparing Credit Repair Companies

Conclusion: Is Credit Join the Right Choice for You?

Ultimately, the decision of whether or not to use Credit Join is a personal one. By carefully considering the factors discussed in this article – including transparency, compliance, customer feedback, and services offered – you can determine if Credit Join is a legit company that aligns with your credit repair goals. Remember to do your due diligence and choose a company that you trust. Is Credit Join the right choice? Only thorough research can provide the answer.

FAQ

- What is Credit Join?

- How does Credit Join work?

- What are the fees associated with Credit Join?

- Are there any guarantees with Credit Join?

- How can I contact Credit Join?

- What are the alternatives to Credit Join?

- How long does credit repair typically take?

Need further assistance? Contact us!

Phone: 0915117113

Email: [email protected]

Address: To 3 Kp Binh An, Phu Thuong, Viet Nam, Binh Phuoc 830000, Viet Nam

We have a 24/7 customer support team available to help.

You may also be interested in these other articles on our website:

- Understanding Your Credit Score

- How to Dispute Errors on Your Credit Report

- Tips for Improving Your Credit Score

We encourage you to explore these resources to further enhance your understanding of credit repair and make informed decisions about your financial future.